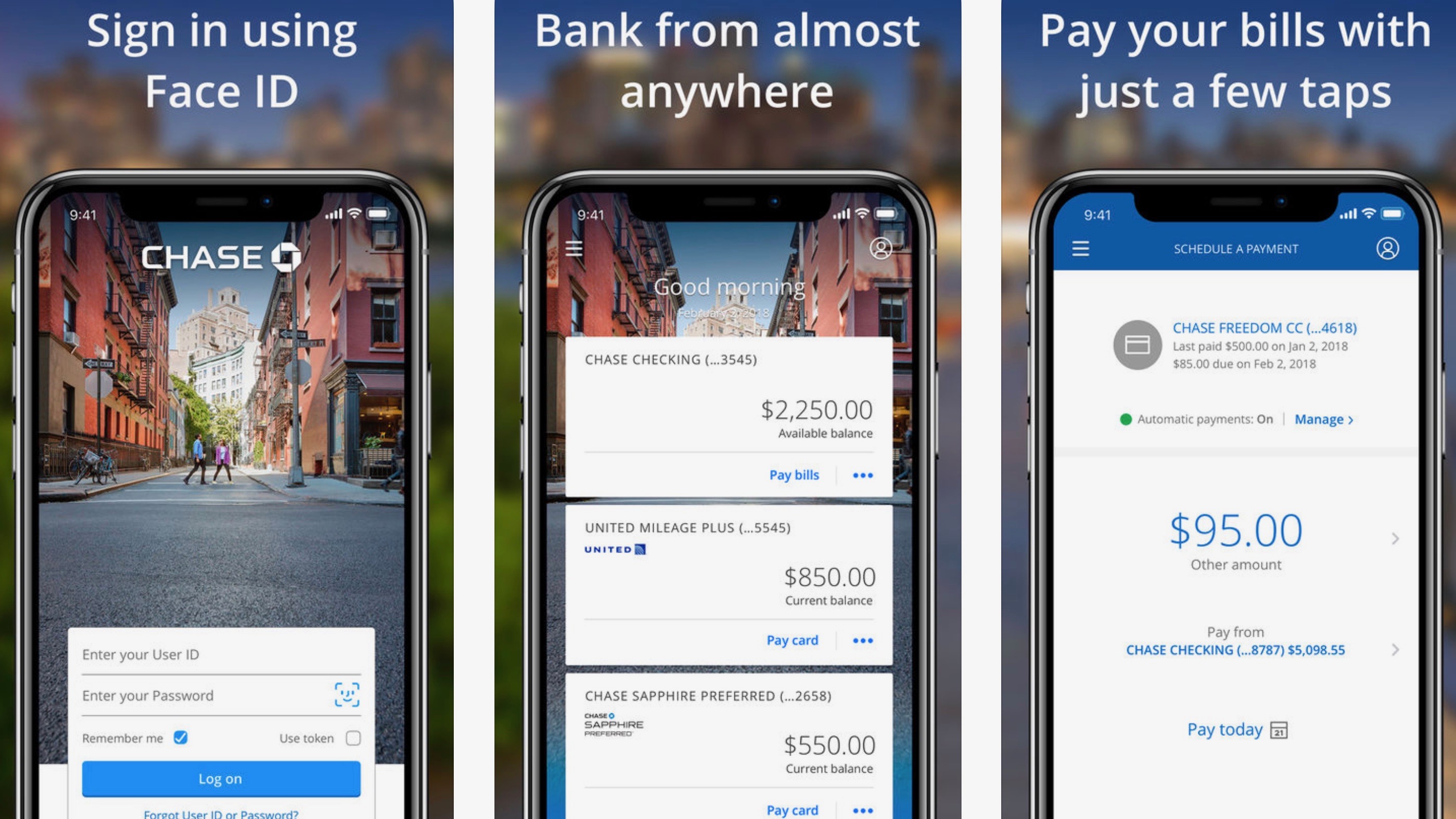

Make sure you take advantage of all the rewards and the fee-free spending abroad. If there's one thing you'd tell a friend who's thinking of getting this, what would it be? Honestly, the best bank account ever and I'd recommend it to everyone. I've also used my Chase card while away on holiday as there are no fees. The app is easy to use, and the pots really help keep my goals on track. I've benefited so much from the cashback, and the saving round-ups have really helped me as well. Since opening the Chase account I've used it as my day-to-day account, as well as a savings account. My sister told me about the cashback rewards and it seemed like a no-brainer to sign up. You can’t deposit cash or cheques into the account, and Chase does not yet offer overdrafts. Chase says that you can reach a customer service agent (no bots) at all hours of the day through its app. To help you manage your money via the mobile banking app. The debit card is also made from recycled plastic (rPVC). This helps to keep your card details safe (you can view your card number, expiry date and security code in the app if you need to). The account is instant access and there is no minimum opening balance. Here you can earn 3.3% AER variable interest daily (paid on a monthly basis). Another feature that the bank has added since its initial launch is a linked Chase saver account. Every 12 months, the money you’ve rounded up is transferred to your Chase current account and you’re free to start saving all over again. You can round up your debit card transactions to the nearest pound, set the money aside in a linked round-up pot, and Chase will pay 5% interest on this amount. 5% interest on savings generated by the “round-ups” feature.1% AER interest on your current account balance. For existing customers, cashback was originally due to expire after 12 months, but was extended by a further 12 months. New customers can get this perk for their first year but cashback is capped at £15 a month. This applies to a wide range of purchases, including groceries, travel, meals out, entertainment, fashion, homewares and holidays. Chase did not offer this option when the account first launched, but you can now set up direct debits to be paid from your Chase account and manage them in the app. Handy for all you keen travellers out there. There are also no charges for using your Chase card to make purchases or take out cash at ATMs overseas. Free spending and cash withdrawals abroad.There are no fees for opening or operating this account. This is what you can expect from Chase’s digital-only current account: What are the features of the Chase current account?

0 kommentar(er)

0 kommentar(er)